Still have questions? Let's talk.

For further queries or more information, please get in touch. Let’s continue growing our Nomi community together!

Want to chat?

We'd love to hear from you.

FAQs

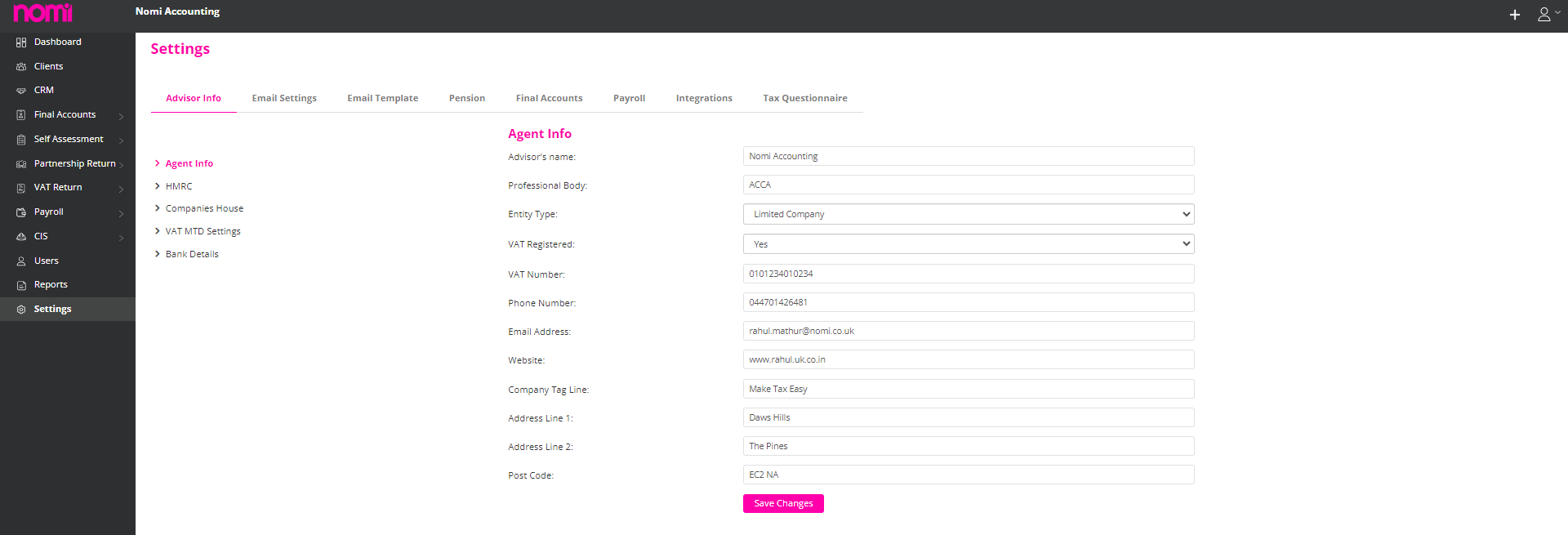

For this, you will have to navigate to Agent Hub>>Settings>>Advisor Info>>Agent Info. As a financial advisor or accountant, updating your details is crucial as the data updated under Agent Info is utilised under different modules for Advisor Information.

The process is simple. Begin by entering your first and last name, followed by the professional body from which you are certified. This ensures that clients know you are a qualified expert in your field. Next, choose the form of business or practice entity that best describes your firm.

If you are registered for Value Added Tax (VAT), indicate it, and enter your VAT number.

This ensures that clients are aware of your tax status. If you are not registered for VAT, select “no” from the dropdown menu. In addition, make sure to update your contact details, including your phone number, email address, and website.

You can also add a tagline to your practice, which can help you stand out and make a lasting impression. Finally, make sure to update your firm’s address details. Updating your Agent Info is a crucial step in the setup process.

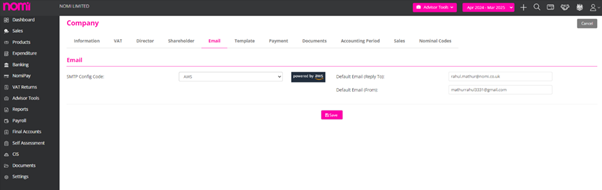

To get the emails to work, you must update the SMTP settings at the client level in Nomi.

To configure the email settings in Nomi, follow these steps:

By default, CRM access is not provided under any account. This is something which is provided by the Support/Sales Team at the request of the user. The CRM Instance is created and after that, a CRM option shows on the left-hand side whenever a user logs into Nomi.

Ensuring that submissions are complete, accurate, and timely can help minimize delays. If a submission remains pending for an extended period, contacting Companies House for clarification and guidance is recommended. However, if it is pending for more than expected, you should click on ‘Get Response’ or refresh the submission screen every 5 minutes until the response is fetched from the Companies House. Additionally, you can also click on the Companies House link and check whether the submission is updated on Filing History.

Submissions to Companies House may be marked as “Pending” for several reasons. Understanding these reasons can help ensure that your submissions are processed smoothly and efficiently. Here are some common reasons why a submission might go under “Pending” status:

Reasons for Pending Status

Steps to Address Pending Submissions

Submissions to Companies House going under “Pending” status are not uncommon and can be due to a variety of reasons, from processing times and incomplete information to manual reviews and technical issues.

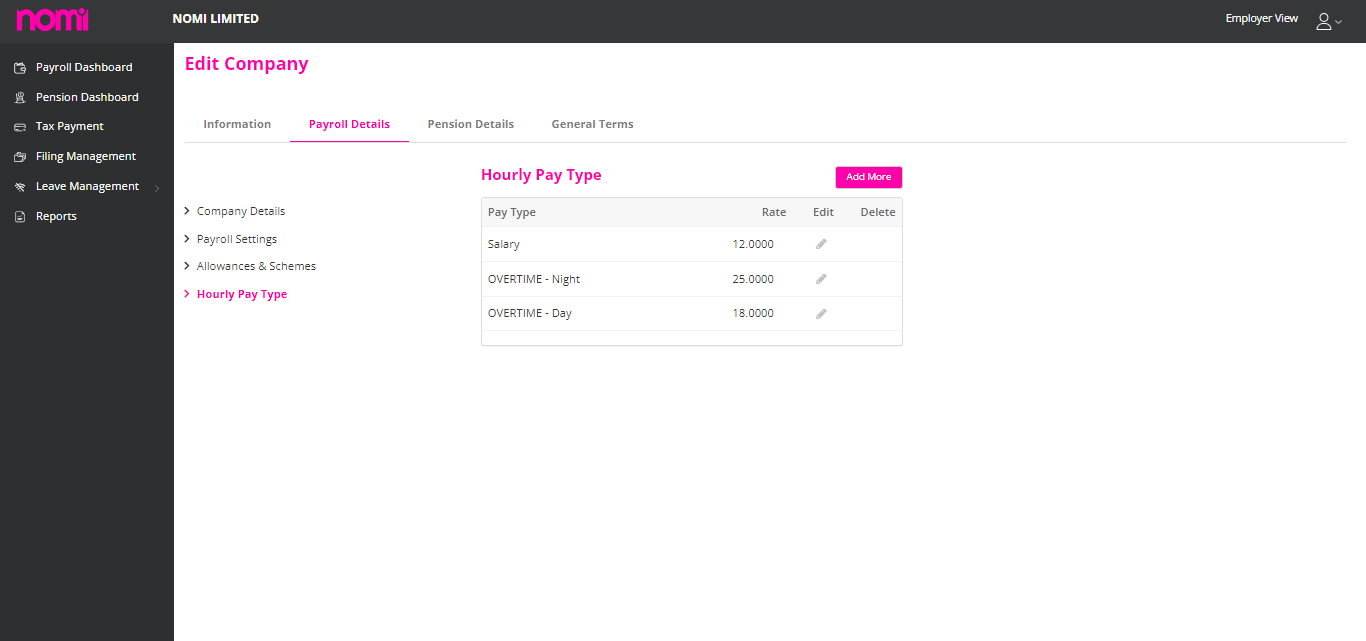

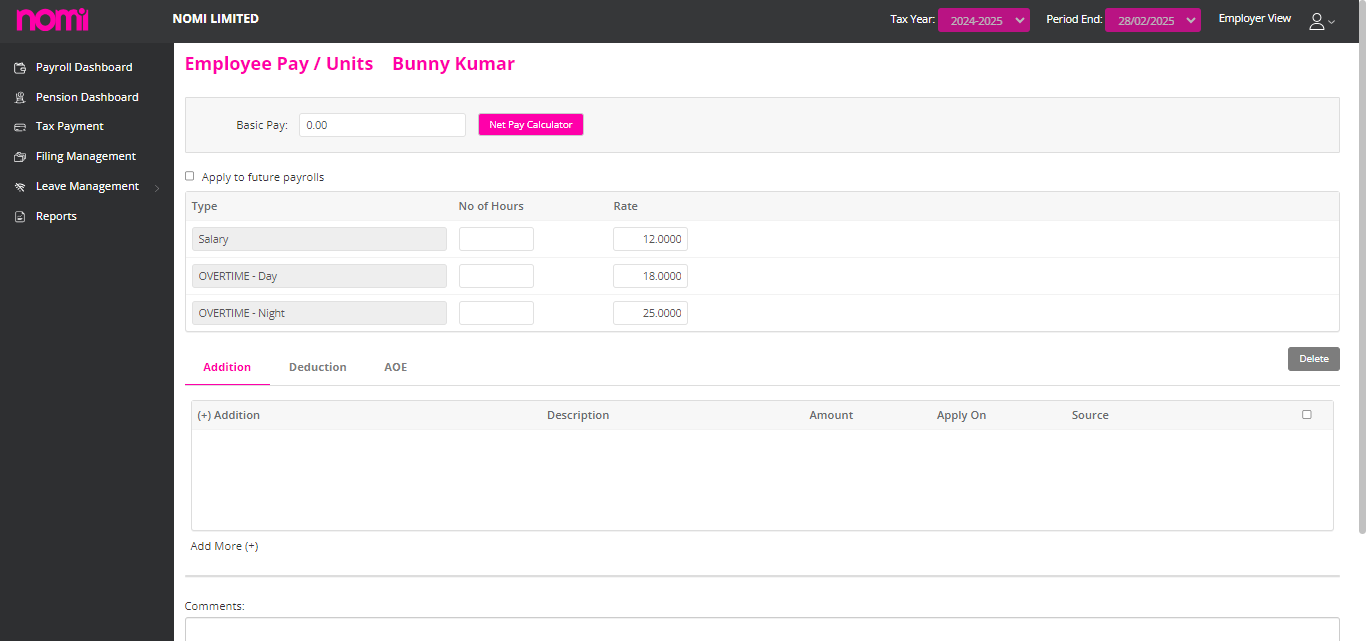

To add the hourly pay rate you will have to navigate to Agent Hub>>Clients>>Payroll Service>>Payroll Dashboard>>Edit Company>> Payroll Details>>Hourly Pay Type.

After adding multiple rates or even a single rate i.e. Pay Type the same is updated for all the Employees who are paid on an hourly basis. You can check this by navigating to Payroll Dashboard>>Click on Employee Name>>Click on Edit Employee (top right corner)>>Employee Details>>Pay Details.

1 For the reports that are sent across through Nomi the password is usually the Date of Birth of the Individual (dd/mm/yyyy) format, these reports especially those containing sensitive or confidential information are often password-protected for several key reasons:

Password-protecting reports in the UK are a critical practice for safeguarding sensitive information, ensuring compliance with legal and regulatory requirements, preventing unauthorized access, and maintaining the integrity and authenticity of important documents. It is a fundamental aspect of effective data security and risk management strategies for organizations.

For further queries or more information, please get in touch. Let’s continue growing our Nomi community together!

We'd love to hear from you.